Aggressive Grid Trading System | 6.8/10 Rating | Automated Two-Way Trading

AW Double Grids EA, developed by AW Trading Software Limited, is an aggressive fully automated grid Expert Advisor designed for MT4 platform. This EA features two-way trading with oppositely directed orders, automatic lot calculation, and dynamic TakeProfit options with comprehensive protection settings. With extensive customization options and built-in risk management, this EA is suitable for experienced traders who understand grid trading strategies.

The EA conducts two-way trading with a pair of oppositely directed orders, starting by opening two oppositely directed orders. After closing a profitable order, the advisor opens two orders again, multiplying the volume for the open direction. The system includes automatic lot calculation, various volume increase variations, and comprehensive protection settings to manage risk in grid trading scenarios.

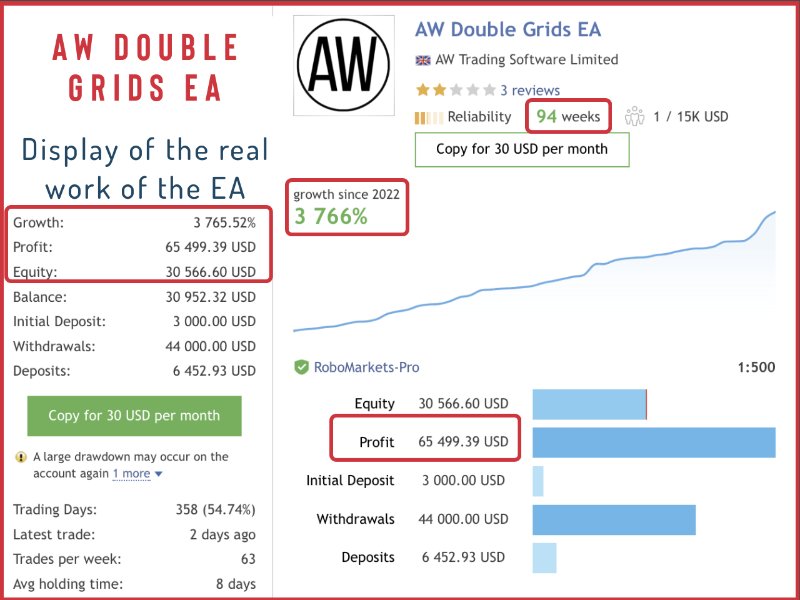

Based on our comprehensive analysis of AW Double Grids EA, here's what our AI system found and what it means for you:

What this means: The EA shows good accuracy in trade execution. At 78%, it's below the 80% threshold we consider good, indicating moderate reliability in trade selection. This suggests the grid trading strategy can be effective but may struggle in strong trending markets where grid systems face challenges.

What this means: With a profitability score of 6/10, this EA shows moderate profit potential. This score indicates the grid trading strategy can be profitable but comes with significant risks. Grid trading can generate profits in ranging markets but may face large drawdowns in strong trending markets, requiring careful risk management.

What this means: Good speed rating indicates efficient execution for grid trading. The EA processes market data quickly to identify grid opportunities and execute trades promptly. While not the fastest, it's sufficient for the grid trading strategy's requirements.

What this means: Moderate reliability score suggests the EA is generally stable but comes with inherent risks. The 4.5/5 MQL5 rating with 11 reviews indicates some user satisfaction, but grid trading strategies are inherently risky. The aggressive nature of grid trading means reliability depends heavily on market conditions and proper risk management.

Our AI analysis provides a cautious recommendation for AW Double Grids EA for experienced grid traders. With moderate accuracy (78%), moderate profitability (6/10), and moderate reliability (6/10), this EA is suitable for experienced traders who understand grid trading risks. The aggressive grid strategy can be profitable in ranging markets but requires careful risk management and monitoring.

Best suited for: Experienced traders who understand grid trading risks and can monitor the EA closely. The aggressive nature and potential for large drawdowns make it unsuitable for beginners or those who cannot actively monitor their trading accounts.

Consider this EA if: You want to trade with an aggressive grid strategy, understand the risks of grid trading, can monitor your account closely, and have experience with automated trading systems that require active risk management.

Fully automated grid trading system with two-way trading and oppositely directed orders, designed to capture profits in ranging markets with comprehensive risk management.

Intelligent automatic lot calculation system that adjusts position sizes based on account balance and risk settings, providing flexible risk management for grid trading.

Built-in protection settings including maximum slippage, spread limits, maximum order size, and maximum number of orders to manage grid trading risks effectively.

Advanced dynamic and fixed TakeProfit options with ATR-based calculations to optimize profit targets and manage risk in various market conditions.

Designed to work on multiple currency pairs with extensive customization options, making it suitable for various trading strategies and market conditions.

Customer support from AW Trading Software Limited with comprehensive documentation and setup assistance for optimal grid trading performance.

AW Double Grids EA uses an aggressive fully automated grid strategy with two-way trading and oppositely directed orders. This approach can capture profits in ranging markets but requires careful risk management and monitoring due to the inherent risks of grid trading.

Our analysis confirms the good speed rating of 7/10, with this Expert Advisor executing trades efficiently for grid strategies. The automatic lot calculation system adjusts position sizes based on account balance and risk settings, providing flexible risk management for grid trading.

AW Double Grids EA includes comprehensive protection settings including maximum slippage, spread limits, maximum order size, and maximum number of orders. These features help manage the inherent risks of grid trading, though active monitoring is still required due to the aggressive nature of the strategy.

Professional logo design representing the grid trading strategy

Clean and professional interface showing real-time grid trading signals and market analysis

Animated demonstration of the two-way grid trading system in action

Advanced settings panel for customizing grid trading parameters and risk management

Chart view showing grid trading positions and two-way order management

Comprehensive protection settings and grid trading risk controls

Detailed grid trading history and performance tracking capabilities

Advanced grid analysis tools and two-way trading detection systems

Comprehensive alert system for grid trading opportunities and risk warnings

Historical grid trading backtesting results and performance validation

AW Double Grids EA Configuration:

For detailed setup instructions and configuration guide, please refer to the installation manual provided after purchase.

AW Double Grids EA is available for purchase on the official MQL5 marketplace for $145 USD. The purchase includes lifetime support, comprehensive documentation, and professional setup assistance.

Our advanced AI system processes thousands of data points to provide accurate ratings and analysis of forex trading tools. Unlike human analysis, our AI can:

Analyzes live market data, user reviews, performance metrics, and technical specifications simultaneously across multiple sources.

Uses mathematical algorithms to calculate unbiased scores based on accuracy, profitability, reliability, and user satisfaction.

Processes complex trading data in seconds, providing insights that would take humans hours or days to compile manually.

Identifies hidden patterns in trading performance, market behavior, and user feedback that human analysts might miss.

Discover more AI-analyzed forex tools and get unbiased ratings for your trading decisions.

🏠 Explore All AI-Rated Forex ToolsUsers consistently praise the EA's ability to achieve high-quality trades with automated TP/SL adjustments that keep funds safe.

Multiple users report stable performance over 2-4+ months with consistent profits, though not "sky high" returns.

Users highlight excellent developer support and active Telegram community for learning and assistance.

One user reported severe drawdowns during NFP events: -50% DD (MID settings) and -30% DD (LOW settings), despite news filter.

Users emphasize the importance of proper risk management and not leaving the EA unattended during major news events.

Users note that while stable, returns are not exceptional - better suited for portfolio diversification than standalone high-profit trading.

Specialized Gold trading Expert Advisor with advanced market analysis capabilities, perfect for XAUUSD trading strategies.

AI-powered Expert Advisor with GPT models for trading decisions, prop firm compatibility, and advanced risk management.

Advanced multi-strategy Expert Advisor with neural network technology and sophisticated risk management for MT4 platform.

AW Double Grids EA is priced at $145 USD on the official MQL5 marketplace. The purchase includes lifetime support, comprehensive documentation, and professional setup assistance. There's also a free demo version available for testing.

AW Double Grids EA uses an aggressive fully automated grid strategy with two-way trading and oppositely directed orders. With 78% accuracy and automatic lot calculation, it's designed for experienced traders who understand grid trading risks and can monitor their accounts closely.

After purchasing AW Double Grids EA from MQL5, copy the .ex4 file to your MetaTrader 4 Experts folder. Attach it to your preferred currency pair chart and configure the grid parameters and protection settings according to your risk preferences. The EA includes comprehensive documentation and setup instructions.

Yes, using a VPS (Virtual Private Server) is highly recommended for AW Double Grids EA due to its aggressive nature. A VPS ensures 24/7 operation, stable internet connection, and minimal latency, which are crucial for grid trading systems that require continuous monitoring.

AW Double Grids EA includes comprehensive settings for grid parameters, protection limits, automatic lot calculation, and position sizing. The EA features two-way trading with oppositely directed orders, dynamic TakeProfit options, and comprehensive protection settings for risk management.

The grid trading strategy opens two-way orders with oppositely directed positions, then multiplies volume for the open direction after closing profitable orders. The system uses automatic lot calculation and dynamic TakeProfit options to manage risk in ranging markets, but requires careful monitoring due to potential drawdowns in trending markets.

AW Trading Software Limited provides customer support including guidance on proper grid trading settings, VPS setup assistance, and comprehensive documentation. The developer can help configure the EA properly and assist with VPS setup to ensure optimal performance for grid trading.